Showing posts with label WPG. Show all posts

Showing posts with label WPG. Show all posts

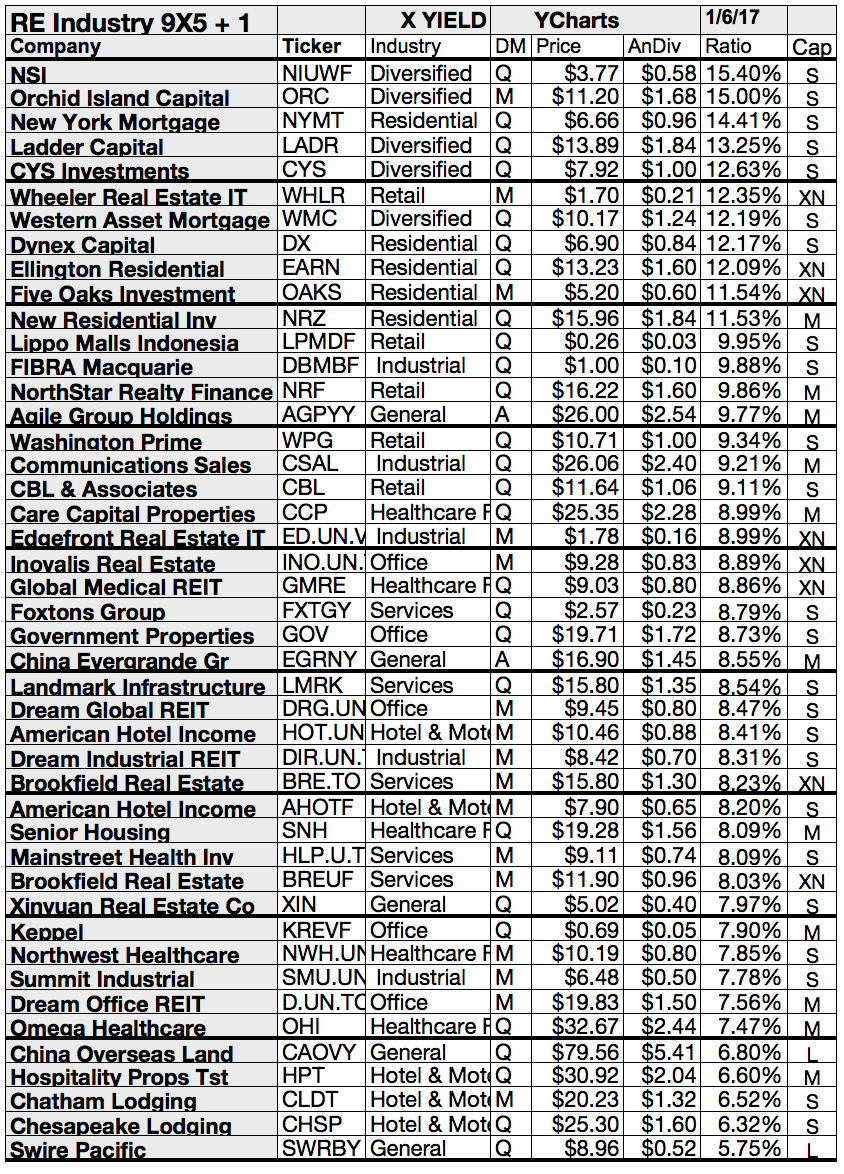

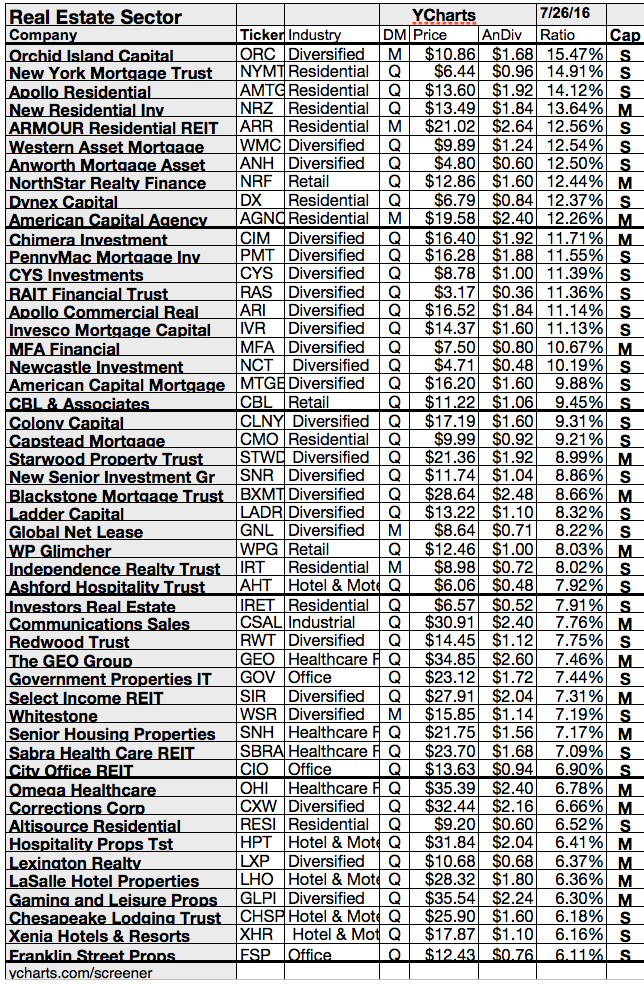

15 REITs With FFO Yields Over Dividend Yield

FFO is meant to provide the best measurement of a REIT’s cash flow available for dividend payments.

If you are thinking about a REIT purchase, you need to consider the company’s ability to maintain or raise its dividend, because a dividend cut could hurt the stock price terribly, and income is your main objective.

There are 92 REITs in the S&P 1500 Composite Index and some of them still have room to grow dividend payments. Here are the 15 with the highest dividend yields that also have “headroom” to raise dividends:

If you are thinking about a REIT purchase, you need to consider the company’s ability to maintain or raise its dividend, because a dividend cut could hurt the stock price terribly, and income is your main objective.

There are 92 REITs in the S&P 1500 Composite Index and some of them still have room to grow dividend payments. Here are the 15 with the highest dividend yields that also have “headroom” to raise dividends:

Ex-Dividend Stocks: Best Dividend Paying Shares On July 29, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks July 29,

2013. In total, 52 stocks go ex

dividend - of which 33 yield more than 3 percent. The average yield amounts to 5.07%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Prospect

Capital Corporation

|

2.50B

|

10.93

|

0.98

|

4.88

|

11.96%

|

|

Kinder

Morgan Energy Partners

|

32.05B

|

39.84

|

3.60

|

3.39

|

6.10%

|

|

Entertainment

Properties Trust

|

2.43B

|

21.00

|

1.67

|

7.40

|

6.09%

|

|

Baytex

Energy Corp.

|

5.19B

|

23.66

|

4.25

|

5.59

|

5.93%

|

|

El Paso Pipeline Partners, L.P.

|

9.49B

|

20.33

|

874.40

|

6.31

|

5.67%

|

|

Omega

Healthcare Investors

|

3.75B

|

27.48

|

3.39

|

10.20

|

5.53%

|

|

National

Retail Properties, Inc.

|

4.10B

|

34.37

|

1.90

|

11.81

|

4.38%

|

|

Enterprise

Products Partners LP

|

55.54B

|

22.50

|

4.00

|

1.30

|

4.32%

|

|

Brookfield

Office Properties CA

|

2.36B

|

-

|

2.74

|

4.47

|

4.31%

|

|

Vermilion

Energy Inc.

|

5.42B

|

29.60

|

3.63

|

5.16

|

4.26%

|

|

Kinder

Morgan, Inc.

|

40.27B

|

41.80

|

2.95

|

3.25

|

3.91%

|

|

Western

Gas Partners LP

|

6.41B

|

87.36

|

3.79

|

7.39

|

3.53%

|

|

Alliant

Energy Corporation

|

5.93B

|

16.52

|

1.88

|

1.86

|

3.51%

|

|

NiSource

Inc.

|

9.78B

|

22.14

|

1.72

|

1.88

|

3.18%

|

|

Texas

Instruments Inc.

|

43.45B

|

24.53

|

3.97

|

3.45

|

2.85%

|

|

ConAgra

Foods, Inc.

|

15.48B

|

19.95

|

2.94

|

1.00

|

2.71%

|

|

Susquehanna

Bancshares, Inc.

|

2.57B

|

16.21

|

0.97

|

3.57

|

2.32%

|

|

Eaton

Vance Corp.

|

4.80B

|

23.27

|

7.37

|

3.81

|

1.95%

|

|

East

West Bancorp, Inc.

|

4.30B

|

15.72

|

1.91

|

4.20

|

1.92%

|

|

Western Gas Equity Partners, LP

|

8.73B

|

137.59

|

12.79

|

10.22

|

1.80%

|

Subscribe to:

Posts (Atom)