Dividend-paying stocks have been bid up in recent years as investors seek alternatives to low bond yields.

But even factoring in the higher valuations, at least one research firm insists that certain dividend-paying stocks still make sense considering the alternatives and the likelihood that monetary policies at various central banks will keep a lid on interest rates for a while.

Stocks with strength in their balance sheets and the reliability of their dividends, could be seen as more risk-free than debt is.

Attached I've compiled a few stocks that offer a high degree of dividend safeness with room to grow them over time.

Each of the results offer a dividend yield over 3 percent.

Here are the results...

17 High-Yielding Dividend Growth Stocks For Passive Income Investors

When it comes to investing, there's arguably no better way to let the magic

of compounding returns do its work than by purchasing and holding solid

dividend stocks.

But while some high-yielding dividend stocks might appear attractive at first, they might not be built to last if strife in the business requires reducing or eliminating their juicy payouts.

Attached you will find a selction of stocks with a rosy long-term persective while paying high dividends now. In short, you can name them high-yielding dividend stocks investors don't need to care about.

Here are the highest yielding results in detail...

But while some high-yielding dividend stocks might appear attractive at first, they might not be built to last if strife in the business requires reducing or eliminating their juicy payouts.

Attached you will find a selction of stocks with a rosy long-term persective while paying high dividends now. In short, you can name them high-yielding dividend stocks investors don't need to care about.

Here are the highest yielding results in detail...

10 Best Stocks To Start Your Dividend Growth Strategy

Dividend investing can add significantly to returns over a lifetime, so beginner investors are right to want to own some dividend-paying stocks in their portfolios.

A company that pays consistent, rising dividends is likely a financially healthy firm that generates consistent cash flow (this cash, after all, is where the dividends come from).

These companies are often stable, and their stock prices tend to be less volatile than the market in general. As such, they may be lower risk than companies that do not pay dividends and that have more volatile price movements.

Because many dividend-paying stocks are lower risk, the stocks are an appealing investment for both younger people looking for a way to generate income over the long haul, and for people approaching retirement - or who are in retirement - who desire a source of retirement income.

Let's say you're looking for a few things: high-quality, solid dividend cash flow and a reasonable valuation. To meet those tests, you could think about something like this:

- Rated A++ in financial strength,

- 3%+ dividend yield and

- P/E ratio under 15.

Now to be sure this is limited, and it may not be exactly what you're after. Yet it does give you a starting point. When I use those metrics, I go from thousands of securities down to less than a dozen:

Here are the results...

A company that pays consistent, rising dividends is likely a financially healthy firm that generates consistent cash flow (this cash, after all, is where the dividends come from).

These companies are often stable, and their stock prices tend to be less volatile than the market in general. As such, they may be lower risk than companies that do not pay dividends and that have more volatile price movements.

Because many dividend-paying stocks are lower risk, the stocks are an appealing investment for both younger people looking for a way to generate income over the long haul, and for people approaching retirement - or who are in retirement - who desire a source of retirement income.

Let's say you're looking for a few things: high-quality, solid dividend cash flow and a reasonable valuation. To meet those tests, you could think about something like this:

- Rated A++ in financial strength,

- 3%+ dividend yield and

- P/E ratio under 15.

Now to be sure this is limited, and it may not be exactly what you're after. Yet it does give you a starting point. When I use those metrics, I go from thousands of securities down to less than a dozen:

Here are the results...

10 Stocks With The Highest Amount Of Cash And Long-Term Investments

Attached you will find a current snapshot of the best in cash swimming stocks on the market. 6 of 10 come from the technology sector. Tech is still a massive cash generating sector in which long-term engaged investors should keep an eye on.

Apple is still the king with over USD 215 billion in cash and short term investments. Compared to the recent year, the amount grew by 21.2 percent which is also the fastest growth momentum on the list.

Check the list here...

19 Shipping Stocks Far Below Book Value; Yields Still Up To 32%

If I screen the market by

interesting investing ideas, one industry often popped on my screen: The

shipping industry.

For sure, the global

trade slows down and commodity costs are at the lowest level for decades. What

looks like bad news for shipping stocks but also a great opportunity for long

term investors?

Let's try a look.

Ships are not equal. These are container ships, tanker etc. and each industry

has a different cyclic.

The recent

correction in share prices across shipping stocks, barring tanker operators,

has transpired into attractive valuations.

While investors

are skeptical of catching falling knives, sitting on the cash means missing

good bargains.

Investors should

adopt a diversified portfolio within the maritime space, to insulate from

heightened uncertainty in the sector.

We have followed

top-down approach to build our model portfolio, while considering company-specific

factors such as the balance sheet strength, financial performance and

management profile for stock selection.

It is important to

note that shipping is a high-beta sector and tends to underperform/outperform

the financial markets by a wide alpha on both sides.

Attached I've

tried to compile a few dividend paying shipping stocks that might look like

bargains due to low price to book ratios and earnings multiples. What du you

think? Are shipping stocks worth an investment? Leave a comment and we discuss

the idea.

Here are the

results...

8 Best Stocks For Retirement Investors

We went hunting for dividend stocks that meet two conditions important to many retirees: first, low risk that the dividend could be cut, and second, reasonable expectations for long-term dividend growth as well as share price gains.

We found eight names worth considering, depending on your goals and risk tolerance. Some offer relatively high yields but slow dividend-growth prospects; some offer lower yields but strong growth prospects; and others are in the middle ground, with decent yields and good growth prospects.

Here are the results...

We found eight names worth considering, depending on your goals and risk tolerance. Some offer relatively high yields but slow dividend-growth prospects; some offer lower yields but strong growth prospects; and others are in the middle ground, with decent yields and good growth prospects.

Here are the results...

20 Really Cheap Value Income Stocks With Yields Up To 32.21%

Dividend investing has always had a certain appeal with investors. Over time, dividend income has comprised a significant portion of long-term stock gains. That's what I've ever told on this blog.

Even better, over the long run, dividend-paying stocks have delivered better total return performance than non-dividend payers and generally have done so with lower volatility.

But the big gain or retirement contribution comes from capital gains. If your income doubles, your investment amount should also double. If the market pays a higher multiple, you could even gain more.

Today I would like to navigate the focus to the cheapest stocks by fundamentals. Price to book and price to sales are two additional important criteria to evalueate the cheapness of a stock.

Attached you will find a list of stocks with solid future earnings growth while P/B and P/S are below the magic 1. The forward P/E is expected below 15. Damn Cheap how we would say.

Here are the results....

Even better, over the long run, dividend-paying stocks have delivered better total return performance than non-dividend payers and generally have done so with lower volatility.

But the big gain or retirement contribution comes from capital gains. If your income doubles, your investment amount should also double. If the market pays a higher multiple, you could even gain more.

Today I would like to navigate the focus to the cheapest stocks by fundamentals. Price to book and price to sales are two additional important criteria to evalueate the cheapness of a stock.

Attached you will find a list of stocks with solid future earnings growth while P/B and P/S are below the magic 1. The forward P/E is expected below 15. Damn Cheap how we would say.

Here are the results....

19 Dividend Achievers With Strong Fundamentals, Solid Growth And Cheap Price Ratios

Investors looking for income usually go for dividends instead on betting on stocks that offer capital gains for wealth creation.

Dividend-paying stocks also provide a cushion against equity market volatility. With Wall Street swinging between bull and bear markets, there are chances of high volatility in the near future.

While a series of mergers and acquisitions gave a boost to the technology market, the unknown impact of the interest rate hike, an aging bull market, the strengthening dollar, lower oil prices and global growth concerns like the Greece crisis and the slowdown in China, are testing investors’ patience.

This instability has compelled many to play safe and depend on dividend-paying stocks for steady returns. After all, such stocks have been the proven outperformers over the long term and are relatively safer bets.

Usually, an investor’s risk tolerance is a major factor that determines how the portfolio is organized. However, it is prudent to have a mix of both growth and dividend-yielding stocks.

Also, while some companies may offer a special dividend to distribute a windfall, it is advisable to choose a consistent performer with strong fundamentals.

Attached you will find a couple of stocks with such strong fundamentals. I restricted my research on long-term dividend growth stocks in order to keep the quality high.

These are my screening criteria in detail:

- Dividend Growth Over 10 Consecutive Years

- Positive Past Sales Growth

- Expected Mid-Term Earnings Growth Over 5%

- Debt To Equity Under 0.5

- Low Forward P/E Under 15

19 stocks fulfilled the above mentioned criteria of which four yields over 3 percent.

Here are the results...

Dividend-paying stocks also provide a cushion against equity market volatility. With Wall Street swinging between bull and bear markets, there are chances of high volatility in the near future.

While a series of mergers and acquisitions gave a boost to the technology market, the unknown impact of the interest rate hike, an aging bull market, the strengthening dollar, lower oil prices and global growth concerns like the Greece crisis and the slowdown in China, are testing investors’ patience.

This instability has compelled many to play safe and depend on dividend-paying stocks for steady returns. After all, such stocks have been the proven outperformers over the long term and are relatively safer bets.

Usually, an investor’s risk tolerance is a major factor that determines how the portfolio is organized. However, it is prudent to have a mix of both growth and dividend-yielding stocks.

Also, while some companies may offer a special dividend to distribute a windfall, it is advisable to choose a consistent performer with strong fundamentals.

Attached you will find a couple of stocks with such strong fundamentals. I restricted my research on long-term dividend growth stocks in order to keep the quality high.

These are my screening criteria in detail:

- Dividend Growth Over 10 Consecutive Years

- Positive Past Sales Growth

- Expected Mid-Term Earnings Growth Over 5%

- Debt To Equity Under 0.5

- Low Forward P/E Under 15

19 stocks fulfilled the above mentioned criteria of which four yields over 3 percent.

Here are the results...

10 Companies With The Biggest Share Buybacks

Attached you will find a list of the stocks with the biggest share buybacks of the recent quarter. Apple is still the king of buybacks, also due to its large cash flow and big size.

The tech company bought 6 billion in own shares. Number two is United Technologies.

The military stock purchased 5.1 billion in own shares back. You can also see the amount of dividends paid in the list. It's also good to see that shareholders received cash dividends.

Here are the biggest share buyback stocks of the past quarter....

The tech company bought 6 billion in own shares. Number two is United Technologies.

The military stock purchased 5.1 billion in own shares back. You can also see the amount of dividends paid in the list. It's also good to see that shareholders received cash dividends.

Here are the biggest share buyback stocks of the past quarter....

The Next 20 Dividend Kings: Stocks With 44 Years Of Consecutive Dividend Growth And More To Come

First, though, a reminder of why you should consider dividends for your portfolio.

First, though, a reminder of why you should consider dividends for your portfolio. For starters, they generate income, which is obviously welcome in retirement, but it can also be welcome when you're younger, as dividend dollars can be reinvested in additional shares of stock, building your nest egg.

It's really important to look how many cash you get back from your investment in the future. Recently I wrote about dividend growth and the benefit of long-term dividend growth investing. I summarized all Dividend Kings in a list.

Today I would show you those stocks that are close to Dividend Kings and should become a full hero in five years or so.

I call the selection the next 20. Each of the stocks has grown dividends over at least 44 years without an interruption.

Here are the results...

18 Cheap Dividend Growth Stocks To Consider Now

Instead of just buying a stock that’s cheap, or one that’s growing earnings fast, we look for stocks that appear decently priced with respect to year-over-year growth.

For example, a company growing 15% annually with a price-to-earnings (P/E) ratio of 15 or less would be considered cheap by growth at reasonable price standards.

Attached you will find a compilation of dividend growth stocks that which I have screened by growth at reasonable price standards.

I only screened stocks with a 10 year plus dividend growth at 10% earnings growth and less than 15 P/E multiple.

In order to avoid debt overloaded stocks, I decided to select only those stocks with a debt to equity under 1.

18 stocks remain. Attached you will find the results compiled in a list with important fundamentals.

Here are the best yielding results in detail...

I only screened stocks with a 10 year plus dividend growth at 10% earnings growth and less than 15 P/E multiple.

In order to avoid debt overloaded stocks, I decided to select only those stocks with a debt to equity under 1.

18 stocks remain. Attached you will find the results compiled in a list with important fundamentals.

Here are the best yielding results in detail...

The Benefit Of Dividend Growth And Which 17 Stocks Climped To The Top Of The Dividend Champions List

When the market is in a slump, healthy and growing companies will usually keep paying their dividends, offering some relief in challenging times.

When the market is in a slump, healthy and growing companies will usually keep paying their dividends, offering some relief in challenging times. And here's something underappreciated: Dividend payers actually tend to perform really well, too.

Dividend-paying stocks averaged an annual gain of 9.3% from 1972 through 2014, while non-dividend payers averaged just 2.6%. Want more? According to Fidelity data, from 1993 through 2014, dividends accounted for about 40% of the 10.3% average annual return of the S&P 500.

Attached I've compiled those dividend growers with the longest dividend growth history. Only a couple of stocks managed to grow their dividends over decades without running them flat a year or even reduce them.

17 stocks joined the exclusive club of Dividend Kings. Those stocks managed to raise dividends over a half century without an interruption.

That's a great success if you keep in mind how many recessions come and go over that period of time.

Here is the latest overview of the Dividend Kings List...

10 Highly Profitable, High-Yield And Growth Orientated Stocks You Should Know

Right now there are roughly 1,400 companies in the U.S. that pay regular cash dividends, and they pay out in total about $410 billion.

Right now there are roughly 1,400 companies in the U.S. that pay regular cash dividends, and they pay out in total about $410 billion. The dividends are in effect the vegetables. They’re the nutrients underneath the stock market that allow it to grow over time. Over long periods, that American dividend stream has grown at roughly 5.5% per year.

Over the last five years dividends in the S&P 500 have compounded about 13% per year. That’s in a period where the S&P 500 returned 14.5% per year. So the lion’s share of the equity return was driven by aggregate dividend growth.

Dividends are important but growth too. The optimal way to invest is to mix growth with dividends. Secondly, a corporate should grow at highly profitable rates. It does not make sense to scale a money loosing system to get poor.

Attached you will find 10 highly profitable growth orientated stocks that might deliver solid returns in the future.

10 Stocks I found related to the issue are....

30 Fast-Growing Dividend Growth Stocks For High Total Return

Dividend growth is

important for investors who like to put money into stocks and follow a buy and

hold strategy until they retire.

Dividend growth is

important for investors who like to put money into stocks and follow a buy and

hold strategy until they retire.

If the company

growth and with them the dividend payout, your passive income should also grow

and your investment finally be higher.

Attached you will

find a nice overview of the best dividend growth stocks of the recent decade

sorted by short-term, mid-term and long-term dividend growth.

For sure the past

performance is no guarantee for growth in the future but it gives a nice

overview about the good stocks in the past.

Maybe you own some

of them and you have made a decent amount of money with your investment.

Here are the best dividend growth stocks of the past...

Gold Comes Back: Here Are The 15 Best Dividend Ideas From The Industry

Dividend stocks – that term says a

lot. You buy a stock and on a recurring basis it pays you a cash

dividend....And over time, thanks to those cash distributions and capital

appreciation fueled by shareholder loyalty, the stock price rises.

Dividend stocks – that term says a

lot. You buy a stock and on a recurring basis it pays you a cash

dividend....And over time, thanks to those cash distributions and capital

appreciation fueled by shareholder loyalty, the stock price rises.

That’s a great way

to build wealth. Another way is to buy gold. Gold is a true hard value and

should hedge your cash against inflation.

In the past, it

worked really well until gold prices began to crash. In recent days we see a

small turnaround of gold prices. The leading big reserve banks still pumping

tons of money into the market and a fear of recession is increasing.

However, I'm not a

gold investor and don't have any gold stocks but for sentiment or momentum

trader, it could be a great trading idea to bet on rising gold prices with gold

dividend stocks.

Attached I've

compiled all 15 gold stocks that pay a dividend. If you have any comments,

please share your thoughts at the box below. Thank you for reading and contributing.

12 Top Yielding Stocks With Potential To Double Dividends

Dividend stocks can be the foundation of a great retirement portfolio. Not only do the payments put money in your pocket, which can help hedge against any dips in the stock market, they're usually a sign of a financially sound company.

Dividend stocks can be the foundation of a great retirement portfolio. Not only do the payments put money in your pocket, which can help hedge against any dips in the stock market, they're usually a sign of a financially sound company.Dividends also give investors a painless opportunity to reinvest in a stock, thus compounding gains over time. However, not all income stocks live up to their full potential.

Using the payout ratio -- i.e., the percentage of profits a company returns to its shareholders as dividends -- we can get a good bead on whether a company has room to increase its dividend. Ideally, we like to see healthy payout ratios between 50% and 75%.

I run a screen to find some good stock ideas that could offer upside in terms of dividend payments.

My criteria were low payout (under 50%), low debt (under 0.5), solid growth (over 5% for the next five years) and finally a dividend yield over 3 percent. 12 stocks keep on the screen. Each has a market cap over 2 billion.

Here are 12 income stocks with payout ratios currently below 50% that could potentially double their dividends in the future easily....

Here Is How Warren Buffett's Top Holdings Generate Outperformance

With all respect, Warren Buffett is the idol for the common investor. He came out of the middle class and created a fortune of over 50 billion out of nothing.

But his performance lacks behind the market. Does his strategy still work? Attached you will find a detail overview of his 10 top holding. Most of them underperformed the market in recent years.

The top holdings are shown in the table below, realized a yearly return of just 6.62%. Check out the list below where you can also find more statistics.

Recently, I wrote about Warren Buffett's latest portfolio movements. You can read the article here. Warren Buffett's Latest Portfolio Transactions.

Here are Warren Buffett's top holdings in detail...

But his performance lacks behind the market. Does his strategy still work? Attached you will find a detail overview of his 10 top holding. Most of them underperformed the market in recent years.

The top holdings are shown in the table below, realized a yearly return of just 6.62%. Check out the list below where you can also find more statistics.

Recently, I wrote about Warren Buffett's latest portfolio movements. You can read the article here. Warren Buffett's Latest Portfolio Transactions.

Here are Warren Buffett's top holdings in detail...

17 Stocks With Strong Balance Sheets And Growing Dividends

It's better to put money into stocks with growing dividends and strong balance sheets and a solid outlook. For sure you should not expect high rolling returns at triple digit rates but over decades you can expect to grow your invesment.

It's better to put money into stocks with growing dividends and strong balance sheets and a solid outlook. For sure you should not expect high rolling returns at triple digit rates but over decades you can expect to grow your invesment.Stressed assets look like big bargains but you have a face a much bigger risk. Today I would like to focus on those stocks that offer less riks due to a strong balance sheet.

Stong balance sheets have many stocks. Some got a fresh capital injection and swim in cash but their business is cyclic and loses money. Those stocks are not the kind of investment I'm looking for.

In today's screen I've focused on stocks with a 10 year consecutive dividend growth. It's a strong indicator for a stable business.

Here are the best yielding results...

6 Cheap And High Yielding Stocks From The S&P 500 To Outlast A Low Interest Span

Yields on dividend stocks are significantly higher than they were last year, but they’re still pretty paltry compared with historical norms. The yield on the S&P 500 is now up to 2.27%.

Yields on dividend stocks are significantly higher than they were last year, but they’re still pretty paltry compared with historical norms. The yield on the S&P 500 is now up to 2.27%.

In addition to less-than-stellar payouts, decent yields are hard to come by in another way: There’s just not a whole lot of choice.

Only about only about 20 companies in the S&P 500 carry dividend yields of at least 4%. On top of all that, you don’t want to overpay for yield, so you want to identify cheap stocks.

After all, dividend stocks are best used as long-term holdings, and valuations tend to revert to the mean over time.

That means shares with high price-to-earnings multiples are in danger of having a day of reckoning. Cheap stocks, however, can get a boost from multiple expansion.

Attached you can finf 6 large cap stocks from the S&P 500 that might give your a solid and stable return during the low interest environment.

Here are the results...

6 Monthly High-Yield Dividend Stocks To Cover

While income-oriented investors obviously make a point of seeking out reliable dividend stocks, sometimes regular quarterly payouts just won’t cut it.

Those persons who use these dividend payments to help pay monthly bills know a quarterly payout can be more than a little inconvenient at times simply because the incoming and outgoing cash flows aren’t evenly aligned.

Luckily, a few companies actually dish out cash every month rather than every three months.

And there’s a lot more of these monthly dividend stocks than you might think. If you’re looking for a consistent income stream for your portfolio, read on as we look at nine of the top monthly dividend stocks out there.

Here are the results...

Those persons who use these dividend payments to help pay monthly bills know a quarterly payout can be more than a little inconvenient at times simply because the incoming and outgoing cash flows aren’t evenly aligned.

Luckily, a few companies actually dish out cash every month rather than every three months.

And there’s a lot more of these monthly dividend stocks than you might think. If you’re looking for a consistent income stream for your portfolio, read on as we look at nine of the top monthly dividend stocks out there.

Here are the results...

Warren Buffett's 8 Latest Strategic Stock Movements In Detail

In its latest regulatory filing, Warren Buffett's Berkshire Hathaway didn't report too many big surprises, but there were a few notable moves.

Specifically, it appears that Buffett is betting on a rebound in energy and commodity prices, and is harvesting some of his gains elsewhere.

Attached, at the end of this article, you will find a detailed view on his latest buys and sells.

Dividend stocks are in main focus and you will find a detailed introduction of Warren's latest dividend stock buys and sells of the quarter.

Here are the dividend stocks Warren Buffett bought and sold out during Q4/2015...

Specifically, it appears that Buffett is betting on a rebound in energy and commodity prices, and is harvesting some of his gains elsewhere.

Attached, at the end of this article, you will find a detailed view on his latest buys and sells.

Dividend stocks are in main focus and you will find a detailed introduction of Warren's latest dividend stock buys and sells of the quarter.

Here are the dividend stocks Warren Buffett bought and sold out during Q4/2015...

Labels:

AXTA,

Berkshire Hathaway,

BRK-A,

BRK-B,

CBI,

DE,

KMI,

LBTYA,

Portfolio Strategies,

T,

Warren Buffett,

WBC,

WFC

12 Stocks That Might Get A Boost Indirectly From Low Energy Prices

Crude oil’s crash may have roiled

stocks to start 2016, but cheap fuel is actually a great thing for the average

American. Consumer confidence is heading higher, thanks to low gas prices and a

continually improving job market.

Crude oil’s crash may have roiled

stocks to start 2016, but cheap fuel is actually a great thing for the average

American. Consumer confidence is heading higher, thanks to low gas prices and a

continually improving job market.

In general, it

should be good the US economy to have a low oil price. The states are net

import of oil. The cheaper the oil price, the cheaper the energy bill of the

USA.

A negative impact

is expected from the oil and gas industry, especially from own energy companies

like Chevron, Exxon Mobil. A hard environment has share fracker and oil

equipment firms.

Also headwinds

faced by banks with a big loan portfolio related to the energy sector.

Today I would like

to introduce some stocks that might get some backwinds from the low oil price.

It's not only the consumer. Many energy consumption stocks like manufacturer,

travel stocks, airlines could also improve margins due to lower energy costs.

Here are 12 higher yielding stocks that are directly benefiting from more leisure travel. They’re all

on sale at the moment, too.

Here are the results...

Here are the results...

6 Attractive Dividend Growth Stocks That Could Double Dividends Soon

Dividend stocks can be the foundation of a great retirement portfolio. Dividend payments put money into your pocket, which can help hedge against any dips in the stock market, but they're usually a sign of a financially sound company.

Dividend stocks can be the foundation of a great retirement portfolio. Dividend payments put money into your pocket, which can help hedge against any dips in the stock market, but they're usually a sign of a financially sound company.Dividends also give investors a painless opportunity to reinvest in a stock, thus boosting future payouts and compounding gains over time. Yet not all income stocks live up to their full potential.

Using the payout ratio, or the percentage of profits a company returns in the form of a dividend to its shareholders, we can get a good bead on whether a company has room to increase its dividend. Ideally, we like to see healthy payout ratios between 50% and 75%.

I rund a screen in order to find a few attractive dividend growth stocks that could grow earnings and dividends for the years the come.

Leading criteria in my screen are debt-to-equity, 5-Year EPS growth, payout ratio and past sales growth as indicator for the future.

6 income stocks with payout ratios currently below 50% poped on and each of them could potentially double their dividends in the following years.

Here are the results in detail...

20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

This

blog is mainly focused on high-quality dividend paying stocks that delivered a

solid trustful dividend growth history in the past.

I'm also focused on higher yielding stocks because I

do believe that those companies offer a better risk compensation and their

business model allows it to generate a higher amount of free cash which could

be distributed to shareholders.

But you need to look more into the balance sheets and

income statements of a company in order to identify such a cash flow strength.

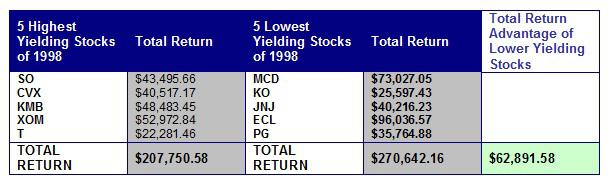

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

A high yield doesn't mean that you will also get a high total return. If you get big dividends but the stock price falls, your return will turn negative.

The attached chart spells out the cost to the investor of focusing on yield over a long period of investing history.

Investors who emphasized yield when purchasing stocks from this group of beloved cherry-picked Dividend Growth stocks missed out on earning the equivalent of a year's worth of a nice middle-class salary over the 18 years studied here.

You might see that a portfolio with lower yielding stocks delivered more total return due to a larger stock price appreciation than higher yielding stocks with lower growth possibilities.

Today I would like to introduce a few lower yielding Dividend Achievers with a fantastic future prediction. The attached list ranks midcap plus Dividend Achievers by its future EPS growth forecast. Only stocks with a debt to equity ratio under 1 were observed.

Here are the 20 top results, sorted by growth...

|

| 20 Low Yielding Dividend Achievers That Might Deliver A Better Total Return Than High-Yield Stocks (click to enlarge) |

20 MLPs To Get Money From Without Filling K-1

For investing purposes, MLPs and LLCs can be a great way to maximize the amount of cash that can be paid to investors, because these organizational structures don't pay income tax, but pass that burden along to those who are invested in it. The same goes for some trust structures.

In other words, because these entities don't pay corporate taxes, the full burden falls on those receiving income from them. This differs from dividend income paid to shareholders by a typical corporation in that regular dividends are taxed as long-term capital gains, while much of the income paid and shown on a Schedule K-1 can be classified as regular income. That means it's taxed at your effective income-tax rate, which is often much higher than the 15% or 20% long-term capital gains rate for corporate dividends.

In summary, a Schedule K-1 issuing entity may be able to pass more income along to you, the investor, but you may end up giving more of it back in taxes than if you'd received regular dividends from a corporation. It really boils down to your tax rate, and how much more income the LLC, MLP, or trust is able to pay.

In order to have less effort with your portfolio allocation and your investment, you could avoid such stocks with K-1 schedules.

Nevertheless, if you like to invest into stocks with a master limited status, you could look at the following list. Each of the stocks are MLP's with status Partnership "C" corporation. Those companies create a classical 1099 Filling and don't send you K-1's.

Here is the list...enjoy it and share it with your social friends...

In other words, because these entities don't pay corporate taxes, the full burden falls on those receiving income from them. This differs from dividend income paid to shareholders by a typical corporation in that regular dividends are taxed as long-term capital gains, while much of the income paid and shown on a Schedule K-1 can be classified as regular income. That means it's taxed at your effective income-tax rate, which is often much higher than the 15% or 20% long-term capital gains rate for corporate dividends.

In summary, a Schedule K-1 issuing entity may be able to pass more income along to you, the investor, but you may end up giving more of it back in taxes than if you'd received regular dividends from a corporation. It really boils down to your tax rate, and how much more income the LLC, MLP, or trust is able to pay.

In order to have less effort with your portfolio allocation and your investment, you could avoid such stocks with K-1 schedules.

Nevertheless, if you like to invest into stocks with a master limited status, you could look at the following list. Each of the stocks are MLP's with status Partnership "C" corporation. Those companies create a classical 1099 Filling and don't send you K-1's.

Here is the list...enjoy it and share it with your social friends...

9 Must-Have Stocks That Should Become Bigger During The Next Recession

When the stock market drops in value, high quality dividend stocks that are less sensitive to the broader economy tend to significantly outperform.

When the stock market drops in value, high quality dividend stocks that are less sensitive to the broader economy tend to significantly outperform.

This means that your performance will also suffer but less than the overall market.

A second issue is that large caps with a big footprint in its industry and healthy financial ratios will perform better in stormy times. Smaller and riskier positioned competitors will be thrown out of the market.

That's why most recession will make market leaders often bigger and stronger.

Companies that consistently raise their dividends tend to be very healthy businesses with long-lasting competitive advantages.

Dividend investors like to look for these stocks in the dividend aristocrats list and the dividend kings list, which contain high quality dividend stocks that collectively outperformed during the last recession and have raised their payouts for at least 25 and 50 consecutive years, respectively.

Attached you will find 9 of the currently most attractive stocks which could grow bigger during a market downturn or a recession.

Here are the ideas...

20 Value Income Stocks With Dividend Yields Over 10 Year Treasury Yield

I found a great list of stocks that combine value investing criteria with growth. The list contains a number of attractive looking stocks with current yields above the bond yield.

It's a classical leveraged view. If you borrow money and put it into investments with a yield over your capital cost, you will make money. Dividends are not stable.

You need a huge spread yield. However, take a look at the attached list. I believe there are a few good names on it.

Here is the table....

It's a classical leveraged view. If you borrow money and put it into investments with a yield over your capital cost, you will make money. Dividends are not stable.

You need a huge spread yield. However, take a look at the attached list. I believe there are a few good names on it.

Here is the table....

10 Dividend Aristocrats That Could Be The Most Successful Companies Over The Next Decade

Dividend Aristocrats are a group of 50 stocks in the S&P 500 Index that have increased their dividend payments for at least 25 consecutive years, a sign of impressive profitability, financial strength, and management's confidence in the business.

Dividend Aristocrats are a group of 50 stocks in the S&P 500 Index that have increased their dividend payments for at least 25 consecutive years, a sign of impressive profitability, financial strength, and management's confidence in the business. Looking at each of the 50 dividend aristocrats on the list today here are the top 10 dividend stocks that could be the most successful companies over the next decade and beyond.

While no one can predict the future, these are likely the best dividend aristocrats to buy and hold for many years to come.

At the end of this article, you will find more fundamentals compiled in a nice list. Hope you get some great ideas from it. If you like those lists, you can easily subscribe here.

Here is what I'm talking about...

40 Leaders And Laggards Of EPS Surprise / EPS Revision

A huge

number of companies have released their Q4 fiscal figures. Market actors are

looking deeply into those numbers in order to compare them with their

expectations.

If a

company does not meet them, it got punished.

Attached

you will find the 10 best and worst stocks that beat expectations in Q4/2015.

You will also find a list of the 10 best and worst stocks with the highest EPS

revisions for the upcoming quarter.

Sometimes

it indicates a clear trend.

Here are the top results...

4 High-Quality Dividend Growth Stocks With Initial Yields Over 3.5% To Buy And Hold Forever

Dividend

growth usually means that a number of positive metrics are being met, and the

company can consistently add to the pot of money that is returned to

shareholders.

Dividend

growth usually means that a number of positive metrics are being met, and the

company can consistently add to the pot of money that is returned to

shareholders.

A stock that offers solid fundamentals, low debt, high

returns, a sustainable underlying business...e.g. has a huge possibility to

grow dividends in the future.

I've always tried to discover those stocks and

introduced hundreds of them in the past.

Today's screen focuses on those stocks that have a solid free cash flow, growth perspectives and an acceptable initial yield while generating double digit returns.

Here are the criteria in detail:

- Market cap that was $3 billion or higher

- Return on invested capital that was 10% or higher over the past 5 years

- Net debt to EBITDA that was less than 1.5%

- Free cash flow yield 6% or higher

- Dividend yield at least 2.5%

- Dividend compounded annual growth rate 5% or higher over the past 10 years

These are the top yielding results:

20 Stocks With At Least One Billion Share Buyback Plan In 2016

When corporations are profitable and established, they tend to return capital to shareholders.

This can be achieved via stock buybacks to shrink the float and to support the stock, or it can be done via one-time dividends or by raising their annualized quarterly dividends.

In my blog, I often cover successful long-term dividend growth stocks. Those companies managed to raise dividends over a decade or half century.

I also talk a little about buyback stocks. Those gave more money back vie share repurchases which is in the end the same.

Today I would give you a short introduction into the biggest share buyback announced from the current fiscal year 2016.

As of now, we've noticed 94 companies with fresh, new, or increased buyback plans.

Here are the biggest announcements from fiscal 2016 to date...

This can be achieved via stock buybacks to shrink the float and to support the stock, or it can be done via one-time dividends or by raising their annualized quarterly dividends.

In my blog, I often cover successful long-term dividend growth stocks. Those companies managed to raise dividends over a decade or half century.

I also talk a little about buyback stocks. Those gave more money back vie share repurchases which is in the end the same.

Today I would give you a short introduction into the biggest share buyback announced from the current fiscal year 2016.

As of now, we've noticed 94 companies with fresh, new, or increased buyback plans.

Here are the biggest announcements from fiscal 2016 to date...

Subscribe to:

Posts (Atom)